TAX RELIEF FOR INVESTORS in LSSE S.A.

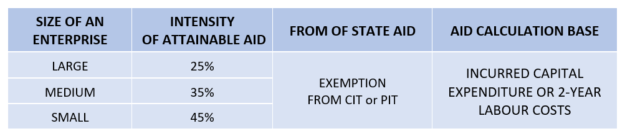

An entrepreneur implementing a new investment project within the area managed by Legnica Special Economic Zone S.A. may be granted with public aid in the form of income tax exemption up to 45% of the value of invested capital or 2-year labour costs.

Map of the area managed by LSSE S.A.

Only the income obtained from business activities, conducted within the framework of an investment covered by the Decision on the Support, may be covered by relief. Thus, if an Entrepreneur also conducts business activity not subject to the support, the supported activity should be organisationally separated, and the amount of the exemption shall be determined on the basis of the data (revenues and costs) of a separated activity.

Eligible costs of a new investment, in accordance with the Regulations on State Aid, shall be, among others, as follows:

- cost of land purchase, cost of either purchase or development or modernization of fixed assets (e.g. machines), purchase costs of intangible assets (computer software, licenses, certificates, etc.) or

- two-year labour costs of employees hired in connection with new investment